Gasoline prices remaining above $1.50 per litre in many provinces, combined with a growing acceptance that fossil fuels have contributed to the increase in severe weather events — from prolonged heat waves to increases in storm intensity — is driving traffic to dealers and manufacturer websites in search of some electron-based relief.

Global accounting giant EY reported in May that, in a market where EVs still account for less than four per cent of sales, more than half of 13,000 people in 18 countries surveyed intend to shop for some version of electric – pure EV, hybrid or plug-in hybrid – for their next vehicle.

“Everybody’s interested. I can’t go to an event, a party, a meeting where somebody doesn’t ask me about EVs,” says Steve Chipman, president of Winnipeg-based Birchwood Automotive Group, which owns 29 dealerships in Manitoba, North Dakota and Saskatchewan.

Steve Chipman, president of Winnipeg-based Birchwood Automotive Group

“The Volvo XC40 Recharge has been a very hot seller for us,” he says. “It’s about six months out. Other stuff is about a year. We’ve stopped taking orders on a number of vehicles. We’re not getting anything.”

The timing of the explosion in demand for EVs comes as the industry remains hog-tied by microchip shortages and other supply chain issues that has slowed production of EVs to a crawl. Despite promising signs from time to time, a recovery in production volume remains elusive.

“I’ve been saying we’re 18 months away for two years now,” Chipman says, laughing. “The manufacturers are saying we’re at the low point in production, so we’ll see.”

The supply issue isn’t just affecting EVs, however. Chipman says including gas, hybrid and EVs, Birchwood has 2,406 vehicles on back order.

Michael Wyant, chief operating officer of the Wyant Group, which owns dealerships in Saskatchewan, Alberta and British Columbia, says consumer anxiety about EVs has nearly vanished, and that’s bringing some surprises into his stores.

Michael Wyant, chief operating officer of the Wyant Group, which owns dealerships in Saskatchewan, Alberta and British Columbia

“People I thought would never buy an EV are asking,” he says. “It’s the highest demand. It’s just there’s such a backlog.”

Wyant says supply at the higher end — Audi e-tron lineup, Porsche Taycan — is best. It’s at the mainstream level — Hyundai IONIQ5, Kia EV6 or Chevy Bolt — where the biggest crunch exists.

“We can get an e-tron or a Taycan in fairly short order,” he says. “Now, we’re clamouring for more of the mainstream, stuff that people are ready to buy right now.”

That relief may not be imminent. General Motors spokesman Phillipe-Andre Bisson says that, while there’s been some improvement in availability of semiconductors — the microchips vital to the operation of on-board computers and other electronics — it’s still not possible to forecast delivery times.

“Without being able to provide an exact timeline, as the delivery time will vary from one region to another, overall we have seen better consistency in semiconductor supply through the first half (of 2022) compared with last year, which has translated into gradual improvement in production” he says. “However, there is still uncertainty and unpredictability in the semiconductor supply base, and we are actively working with our suppliers to mitigate potential issues moving forward.”

The clock is ticking for GM, which is hoping to launch three new EVs next year — the 2024 Chevy Equinox, 2024 Chevy Silverado EV and the 2024 Chevy Blazer.

Audi Canada spokesman Cort Neilsen says almost all of its models are currently four to eight months out. The upcoming Q4 e-tron SUV, however, is 12 months out.

Read more: More than one third of Volvo’s Canadian sales are electrified

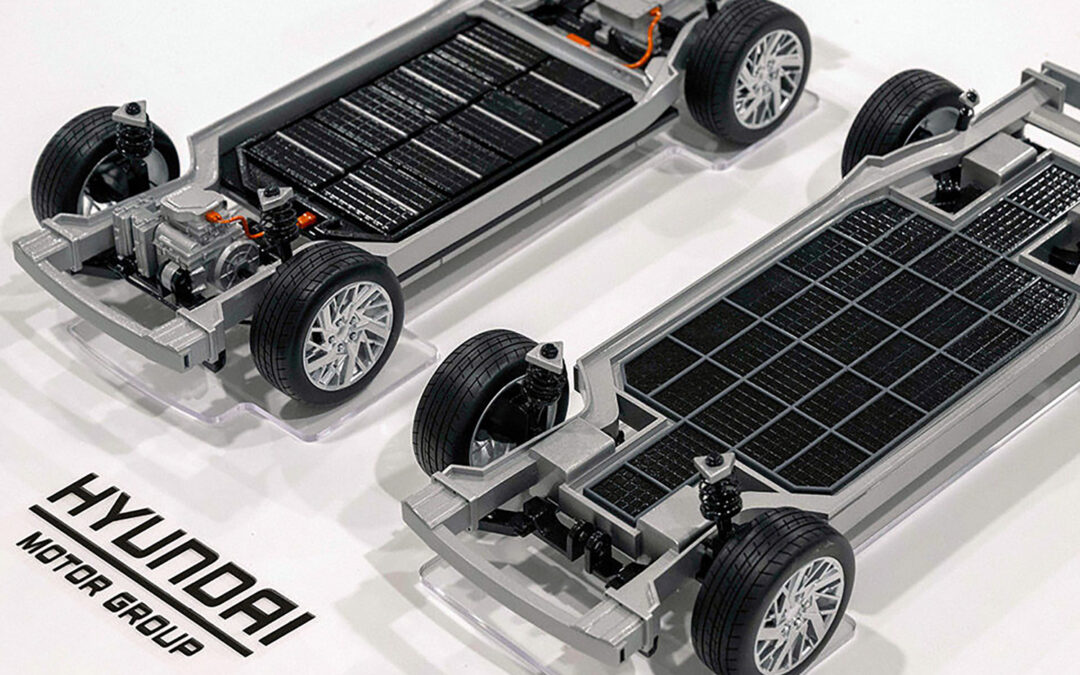

Hyundai, which made quite the splash with the critically acclaimed IONIQ 5 but has also been hit with supply issues, says wait time on orders is dependent on trim levels, region and dealership.

“To ensure fairness among all Hyundai customers across Canada, we have moved to fixed allocation for electrified vehicles and pure EVs,” says spokesperson Jenn McCarthy. “This means every dealer has a different wait time depending on how far in the future they have sold their incoming units.”

Hyundai also has a deadline of sorts approaching, with the new IONIQ 6 expected in early 2023.

Mazda Canada says it’s on pace to meet its goal of selling 700 MX-30 models — the brand’s only pure EV so far — this year. Spokesman Chuck Reimer says that through the end of July, 616 were sold, “which is remarkable given the production constraints that we’ve experienced across all our car lines over the past year or so.”

Mazda MX-30

Reimer said the MX-30 will roll out nationally for the next model year, but says given its commuter focus and lower range than other EVs at the same price point, “we understand the MX-30 is not going to sell in the same volume as some of the competitors.”

For Chipman, the regional disparity in supply is frustrating. He says with only British Columbia and Quebec offering incentives and mandating percentages of EV sales, and with penalties in place for non-compliance, manufacturers unsurprisingly favour those provinces with supply. It leaves customers in provinces without mandates or incentives hanging, he said.

“So manufacturers don’t want to send cars to Manitoba, because they’re trying to meet those mandates.”

That’s certainly the case with EVs such as the Volkswagen ID.4, which isn’t even offered outside British Columbia, Ontario and Quebec yet. That won’t change, at least not immediately, even when supply ramps up, says spokesman Thomas Tetzlaff.

Volkswagen ID.4 production in Chattanooga, Tenn.

“Beginning with model year 23, we will start receiving our ID.4s from the new factory in Chattanooga, Tenn. These will roll out nationwide once we fulfill the orders from Quebec, BC and Ontario that haven’t been delivered.”

Tetzlaff says relief appears to be visible on the horizon. “Dealers across Canada are very anxious to receive the ID. 4, and we’re anxious to deliver them. Fortunately, with the launch of the factory down south, we hope to soon have lots of incoming units, which will take a huge bite out of waiting times.”

Chipman says when the supply situation is finally resolved, dealers will be ready.

“We’re prepared to sell them,” he said. “We’ve got all the chargers, we’ve upgraded the chargers, we have forklifts to move the batteries and extra space to store batteries.

“We’re all-in going forward.”