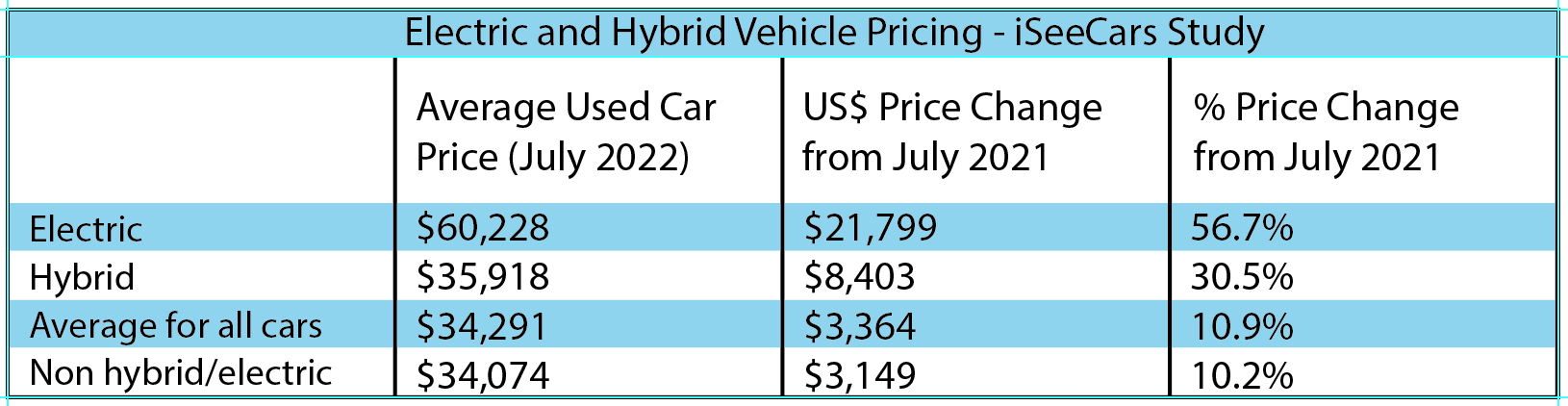

The average value of a used car has been climbing quickly. In July of this year, the average used car price in the US rose 10.9 per cent, or US$3,364, when compared to the value in July, 2021. Now this increase is for all light-duty vehicles. Looking at the electrified market tells a very different story!

iSeeCars Executive Analyst, Karl Brauer, says “We are continuing to see a significant increase in the demand for used electric and hybrid cars as a result of high gas prices, with the average cost of EVs increasing by 56.7 per cent and hybrid cars increasing by 30.5 per cent compared to last year.”

While these are US numbers, “The factors pushing up the price of EVs are the same in Canada and the US. In both countries electric vehicle supply is limited, causing the price to rise.” Brauer says, “I believe everything from climate to price sensitivity is less conducive to EV buying in Canada compared to the US, but there are also fewer EVs in Canada, making the ones that are there more desirable and more expensive.”

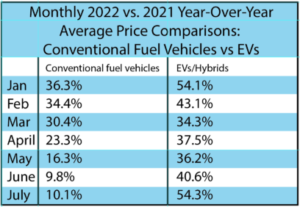

What does become clear from the study is the year-over-year gap between conventionally-fuelled vehicles the electrified market is growing.

The EV domination is underscored when you look at the top 10 used cars with the biggest year-over-year gains — eight of the 10 are EVs. Leading the way is a used Nissan Leaf with a 43.8 per cent increase. Brauer notes, “The price increase for the Nissan Leaf, which was once the highest depreciating car on the market, is likely due to heightened desirability for the redesigned 2018 model that offers increased range and is now coming off lease to enter the used car market.”

The EV domination is underscored when you look at the top 10 used cars with the biggest year-over-year gains — eight of the 10 are EVs. Leading the way is a used Nissan Leaf with a 43.8 per cent increase. Brauer notes, “The price increase for the Nissan Leaf, which was once the highest depreciating car on the market, is likely due to heightened desirability for the redesigned 2018 model that offers increased range and is now coming off lease to enter the used car market.”

The Leaf is followed by the Hyundai Sonata Hybrid (up 43 per cent), Toyota Prius (36.9 per cent), Toyota Prius Prime (34.4 per cent), Toyota Avalon Hybrid (32.4 per cent), Chevrolet Bolt (30.2 per cent), Tesla Model S (27.3 per cent) and Lexus ES 300h (26.8 per cent). The only gas-powered cars on the Top 10 list are the Fiat 500x in seventh place and the Porsche Cayenne in ninth spot. It should come as no surprise the biggest year-over-year losers are gas-guzzlers. The Nissan Armada was in negative numbers (-7.4 per cent) compared to the average used increase of 10.9 per cent.

The uptick in used EV prices is near universal. In fact, looking at the list of used EVs for July 2022, the only vehicle to depreciate was the Porsche Taycan, which dropped 3.5 per cent year-over-year. This, says Brauer, suggests there’s “an upper limit to what consumers are generally willing to pay for used EVs.”

The reason for the elevated value of used cars is down to a number of factors. As noted, the price of gasoline is helping to drive EV prices. However, as the number of new EVs being launched continues to rise so does, “the acceptance of these vehicles, and improvements in EV charging infrastructure has further heightened interest for used EVs.”

Another important consideration is the fact overall demand for new cars is still outstripping supply, and this is likely to continue. How long this situation will last is open for debate, but the consensus seems to be it will be the end of 2023 before many manufacturers have caught up and supply finally begins to match demand.

A sceptic might suggest it will be much further out before normalcy returns to the market place. Few, if any, manufacturers are offering rebates, so profitability is better than it has been in many years. In fact, iSeeCars says the average new car is selling for 9.9 per cent over MSRP — if you can find one!

The reason the supply chain slowed is down to the microchips found in everything from anti-lock brakes and automatic climate control to the power electronics that oversee the electric motors and the seemingly innocuous. The current LED lighting trend is a prime example — an LED is a light emitting diode. When electrical current passes through a microchip it illuminates the tiny light source. The latest LED headlights are awash with them!

The global dearth of microchips has caused a domino effect. Automakers were forced to cut new car production because of the lack of chip availability. This forced many consumers to turn to the used vehicle market, which, in turn, led to a used car shortage. As economics 101 dictates when demand exceeds supply prices rise.

To arrive at these numbers iSeeCars.com analyzed over 13.8 million one-to-five-year-old used car sales between January and July of 2021 and 2022. The average price of each model was calculated monthly in 2022 and compared to the average price of the same model from a year prior.