Subaru of America has confirmed that 825 examples of its new Solterra were sold during the electric SUV’s first official month of sales. And if that seems like an odd lead-in, bear in mind that’s more than Toyota managed during the same period with the ‘sister’ bZ4x.

Subaru’s North America sales – including EVs, PHEVs and ICE cars – rounded out at 556,581 in 2022, a 4.7 per cent decrease on the 583,810 the Japanese brand managed from January to December in 2021, the reasons for which Subaru put down to “semiconductor shortage” and “supply chain disruptions.” But the brand was able to celebrate five consecutive months of sales increases during the closing stages of 2022, with its 56,760 North American sales in December alone an 11 per cent increase over the same month in 2021 (51,146).

2023 Toiyota bZ4X / Neil Vorano, The Charge

Though the likes of Subaru staples like the Outback, the Forester and the Crosstrek – the latter of which also included sales of its plug-in hybrid alternative – bore the brunt of these figures, the Solterra nevertheless held its own during its first official month of sales: of the 919 sold since the electric SUV’s arrival in November, 825 of these were finalized in December.

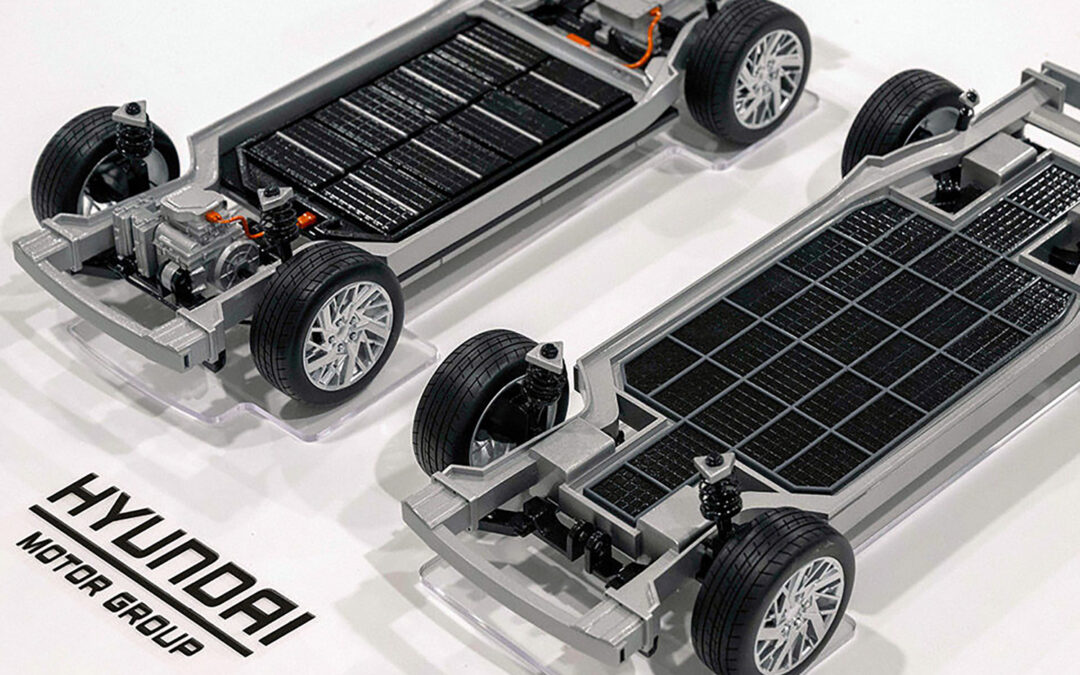

This figure even betters that of Toyota, which sold 1,220 examples of its all-electric SUV, officially launched in Canada in April, during 2022, 634 of which were finalized in December. Given that both the bZ4x and the Solterra share the same co-developed EV platform, it’s interesting to see which brand drew first blood in this ‘internal rivalry.’

Granted, Toyota Motor North America’s sales figures for 2022 take some beating, with its 20 current electrified vehicles accounting for nearly 24 per cent (504,016) of its total sales volume, while electrified vehicles from the Lexus ranks attributed 21.3 per cent. Toyota’s official figures even states that 2022 proved the best ever year for Lexus’ LC Hybrid coupe, and NX Hybrid and plug-in hybrid mid-sized SUVs, as well as hybrid examples of the Toyota Corolla, RAV4 and Tundra.

Admittedly, Toyota’s December 2022 figures for North America make for slightly less cheery reading when you consider that the 2,108,458 total is 9.9 per cent down (daily selling rate) on that of 2021, even if TMNA’s December sales figures were up 3.5 per cent – 180,147 to 174,115 – compared with the same period 12 months prior. Supply chain issues were again noted as a contributory factor.